Who will benefit from the change of oil price

Date:2014-11-03 Views:3271

The oil price rise or not is always people most concerned about in the newspaper. Each time the rise

in oil prices will be accompanied by the news of the damage the interests of consumers and the benefit of producers.

However, this is actually a big misunderstanding. The price of crude oil although can affect other fuel prices,

but similar to gasoline, diesel, other goods have their own rule of prices rise and fall.

Hereon, we try to find out which one will benefit from the change of oil price for you.

Consumers:

The driver all over the world feels that to fill fully their own gas tank with petrol or diesel is very expensive.

It is not widely known by people, however, that most of benefit from the gas station is not flowed to oil producers,

but consumer's national government.

In addition, it is generally believed that oil producers won huge gains by selling oil, and OPEC members in particular.

Although OPEC countries can actually get income from oil, but the greater benefit is in other countries. In OECD countries,

for example, they are basic oil consumption big countries. Many of the tax on the sales of refined oil products let them

have huge benefits.

From the above picture, it is easy to see that the price structure of per liter oil prices in different regions is not the same,

and the main cause of this phenomenon is the difference of tax of different countries in the world. Europe's tax level is far

higher than other countries of the rest of the world, and Japan is relatively high also. On the contrary, Canada and the

United States, the two North American countries tax ratio is low.

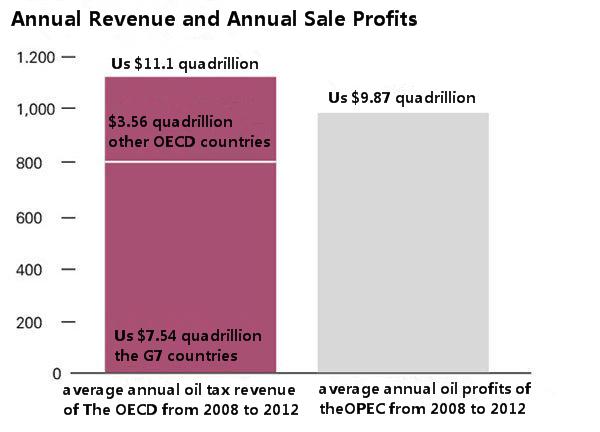

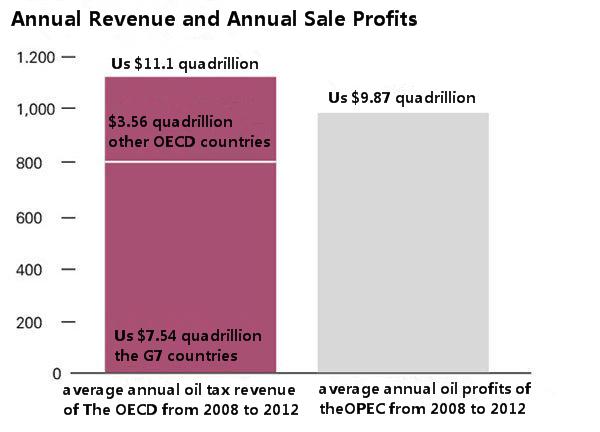

Figure 2 said the oil producer and consumer through taxes leaded to different levels of oil revenues. OECD countries

during 2008-2012 earned $5.553 trillion in tax revenue totally. Over the same period, the OPEC earned $4.888 trillion from

oil sales revenue, which is lower than the oil revenues of OECD countries.

However, their incomes were also different. OECD countries tax was total government revenue of $5.553 trillion.

OPEC countries income had to be removed the costs in the process of exploration, production and transportation.

This shows that oil consumer in final oil revenues was high than oil producing countries.

Figure 3 is a comparison between oil producer and consumer in annual income. OECD countries annual income is much

higher than oil producer, because oil producer needs a lot of money every year devoted to the exploration of oil.

Obviously, consumers’ expenses are mainly to be borne by the government's oil tax revenues, rather than the original price

of crude oil. The government is the main beneficiary of oil production. Next time, when you hear again the gasoline prices

is affected by the price of crude oil at the pump, please remember this, oil price is affected not only by the price of crude oil,

but also by the government's tax revenues.

Oil Structural Proportion in Different Countries of the World